Insurers know that implementing digital changes have the potential to benefit them long term. A recent McKinsey study found that insurers that digitized their processes eliminated 30 to 50 percent of the human service costs. The top quartile of those surveyed achieved 2X the growth of their peers.

“Insurers know that digital transformation is coming. To stand out from your peers, create a secure experience that customers enjoy and trust.”

Tweet This

But specific obstacles in the industry have stalled progress. First, the majority of insurers don't have the in-house technical expertise and equipment to make sweeping changes without support. In addition, many are concerned, particularly in an era of increased scrutiny around customer data, that a system overhaul could threaten measures they've already taken to protect sensitive information.

Despite these real challenges, customers increasingly expect cutting-edge solutions. Other industries, like healthcare and financial services, are quickly incorporating digital methods, raising the bar for everyone. Eventually, insurers will be forced to change. Early adopters will gain an edge, and those who are slow to transform will lose.

While it's possible to begin a digital transformation in many ways — from creating a new claims platform to simply delivering online quotes — starting with an identity and access management (IAM) strategy is a clear, easy-to-implement step that allows managers to attack several core functions at once.

Legacy Systems in a Changing Environment

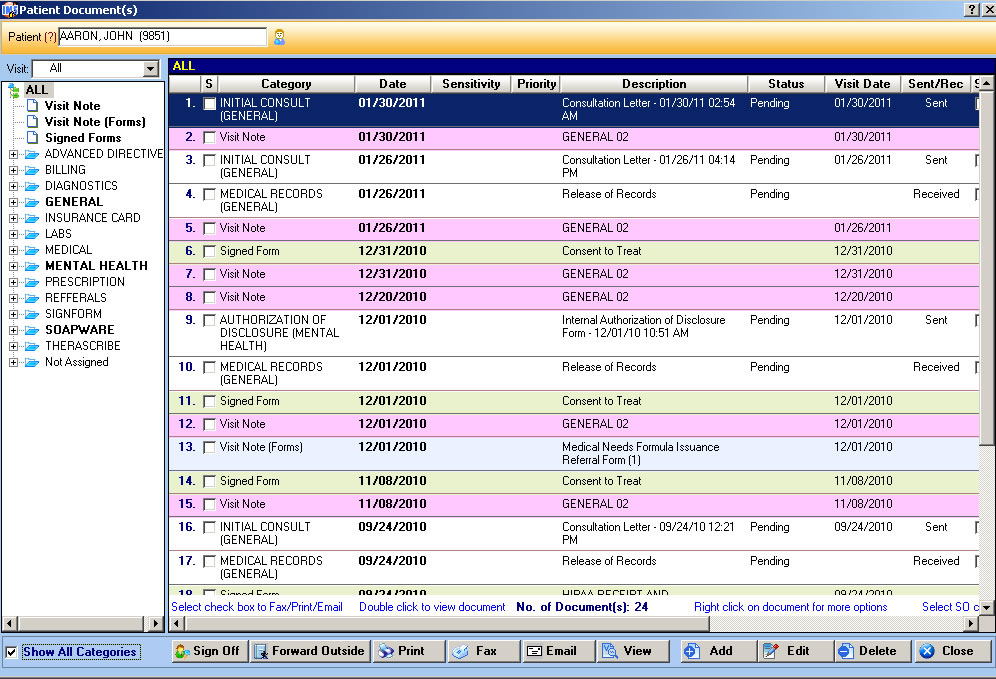

In industries such as retail, many teams are able to rely on consumer data pulled from public sources like social media profiles to underpin their strategies. This might include compiling current and potential customer interests, events they've attended, and pages they've liked. In insurance, it's more complicated. Agents work with higher-touch information sets, like health records and credit scores.

Source: Electronic Medical Records & Electronic Health Records Software

This data is the foundation for building customer risk profiles, determining premiums, and completing claims. Most teams have developed processes over decades that continue to work well. Although a lot of this data exists on legacy insurance softwares and systems and may not be intuitive for new hires to find and work with, more-seasoned agents understand the process and don't feel an urgent need to change.

With such fixed methods, it can be challenging to know why and how to begin to make updates. Tweaking any aspect of an established insurance company's model, even something as simple as market research or reaching out to new prospects, could skew the whole.

Yet if teams don't start somewhere, they risk becoming irrelevant in markets that are quickly evolving. Home insurers, for example, are facing variables such as interconnected home security and heating systems, like the Google Nest; auto insurers are having to factor in autonomous vehicles and the changes that ride-sharing programs like Uber and Lyft bring; even health insurers are seeing stiff competition from newcomers, like Oscar, that have a strong focus on UX and more-affordable plans.

Just because many insurance teams have succeeded with business-as-usual for decades, it doesn't mean they don't need to revamp for the future.

Organize Your Users for Greater Security and Efficiency

For insurance teams facing a daunting set of changes, developing a clear identity and access management - IAM modernization strategy of legacy softwares is a concrete first step. IAM is a simple, initial fix that can form the basis for more updates down the line. It is a single solution for organizing and tracking customers, employees, and even business partners who are working with critical data in your system.

IAM often begins with a portal that collects, organizes, and protects customer data at the login stage. This starts with a simple welcome screen on the front end:

Behind this screen, the technology tracks customer logins and platform behavior and enriches their profiles with personal details and historical records. This can be information that the insurer manually uploads or automatically pulls from public sources. Some features also include additional options, such as progressive profiling, to help build customer data over time (e.g., location, age, and gender).

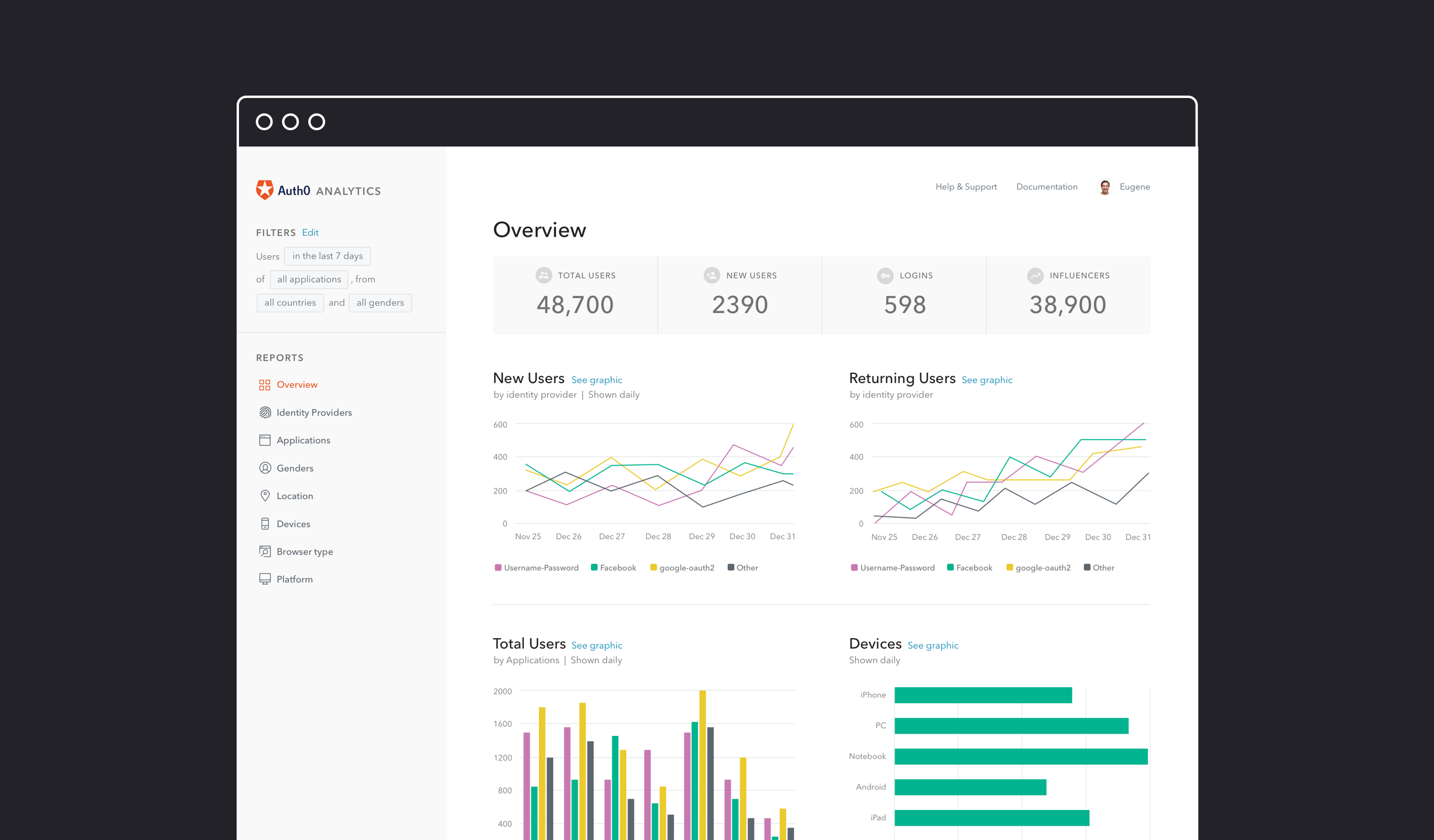

For administrators, certain features allow for a bird's-eye view of all users in a given system, noting growth in users over time, ratio of new to returning users, who is accessing what levels of information at any time– even what device(s) they're using:

Organizing customer data in a single location allows for better tracking, heightened security, and the possibility of gaining sharper insights on customer histories and current behavior. This approach will make your company more efficient at building risk profiles, communicating with customers in a more personalized way (particularly if and when they are in distress and need to make a claim), and understanding your target audience at a granular level.

“Organizing customer data in a single location allows for better tracking, heightened security, and the possibility of gaining sharper insights.”

Tweet This

Outsourcing IAM to the Experts

While you can try to update your IAM system on your own, most insurers don't have the in-house capacity to do so — at least not at the level needed to meet future needs. This would require building a portal that is a one-stop solution for all users — yet is still flexible enough evolve alongside your business. The advantage of outsourcing IAM is having a dedicated team of experts whose entire job, 24/7, is to build and deliver these solutions — as opposed to adding it to a pile of tasks your IT team is currently balancing.

A provider like Auth0 makes sure all of its features adhere to the highest industry standards, including LDAP, SAML, OAuth, OpenID, OpenID Connect, and JSON Web Tokens (JWTs). In addition, it is GDPR, EU-US Privacy Shield, and HIPAA compliant.

[Source](https://auth0.com/security">Auth0 Security)

This eliminates the need for your team to do additional research to ensure any changes are up to code in your geographic area or industry.

Top-notch identity and access management providers like Auth0 will offer even more tools, like 2FA options, to help ease the customer experience. These features can provide a clear measure of safety that customers will immediately appreciate. Each step along the way allows your team to move further away from lagging competitors by gaining user trust, invigorating your brand, and creating more-efficient internal processes.

Be an Early Adopter

If you're an insurer, now is the time to make bold changes to your current strategy. The early digital adopters in the industry will gain sharper insights and win and retain more customers.

No teams will be able to hide from change. With new products constantly coming to market, the industries in which insurance teams operate are themselves being revolutionized. Taking the first step to develop and implement a tight IAM system will open the door for full digital change.

About Auth0

Auth0 by Okta takes a modern approach to customer identity and enables organizations to provide secure access to any application, for any user. Auth0 is a highly customizable platform that is as simple as development teams want, and as flexible as they need. Safeguarding billions of login transactions each month, Auth0 delivers convenience, privacy, and security so customers can focus on innovation. For more information, visit https://auth0.com.

About the author

Martin Gontovnikas

Former SVP of Marketing and Growth at Auth0 (Auth0 Alumni)

Gonto’s analytical thinking is a huge driver of his data-driven approach to marketing strategy and experimental design. He is based in the Bay area, and in his spare time, can be found eating gourmet food at the best new restaurants, visiting every local brewery he can find, or traveling the globe in search of new experiences.View profile